Is it just me or does this pic of Elena Kagan remind you of Nathan Lane in The Birdcage?

Need to fight inflation? Central Banks to the rescue!!

This post by Matthew Yglesias would have me laughing my ass off it it weren’t for the fact that six months ago I wouldn’t have know better myself.

I’ve witnessed a prominent European central banker state, live and in person albeit off the record, that the purpose of central bank independence is to allow him to “fight inflation, regardless of the human cost.”

Matthew, like myself less than a year ago, has no clue what inflation is, and why it exists. Let me lay it out for you, Matthew: A Central Bank is only there to inflate. He is there to make it happen with as little detection as possible. He want you to think that inflation is a natural phenomenon, and that he’s there to keep it in check – disinformation to keep you and others arguing about everything else.

Our Central Bank – The Federal Reserve “System” – was created by bankers so that they could all inflate (loan money long term with “borrowed” demand deposit funds) at a consistent rate, without risk of a bank-run. It also creates new money so that the banks don’t run out of reserves onto which they can inflate further.

“albeit off the record”

As if there’s so much pro-inflation pressure from the public! It’s like the drug cartel saying that their job is to fight drug addiction “regardless of the human cost”. Same as the drug dealer, he’s there to push as much inflation as possible without getting caught. His independence is a ruse – he’s not owned by the public, or a benevolent bunch of do-gooders, he’s owned by the frickin banks! He’s there to inflate the shit out of the money – it’s the way the banks make their money, risk free!

Take the red pill, as I have, and all of this will be clear. Read this book, or download it from iTunes – it’s free. Learn how money originated, how paper money was first used, and how fractional reserve banking is immoral and should be illegal. Learn how bank runs are a natural reaction to people who steal your money, and how the central bank is also a means to protect the thieves from us! Learn how the the central banks partner, big government, get’s its share.

Smashing Myths and Restoring Sound Money

Thomas E. Woods is my absolute favorite economic / historian speaker. I’ve read his book Meltdown, and listened to at least 15 hours of his speeches / lectures, and am convinced he is one of the most compelling speakers of our time. I predict that his work will be renowned far into the future, and I am encouraging my kids to listen him also (believe it or not, they are interested in this kind of stuff!). This is one of my favorite speeches of his:

Spray-on liquid glass

This article about Spray-on liquid glass written by Lin Edwards is exciting enough – if true, this product will be more revolutionary than most anything in my lifetime – on the level of the microware oven… but I was struck by one statement in the article towards the end that seemed to indicate that Lin has absolutely no experience in the business world:

Liquid glass spray is perhaps the most important nanotechnology product to emerge to date. It will be available in DIY stores in Britain soon, with prices starting at around £5 ($8 US). Other outlets, such as many supermarkets, may be unwilling to stock the products because they make enormous profits from cleaning products that need to be replaced regularly, and liquid glass would make virtually all of them obsolete.

What the hell does Lin know about the profitability of cleaning products? If it is commonly known that selling cleaning products is enormously profitable, why wouldn’t the same DIY stores be selling them and also reluctant to sell the liquid glass? Why are the DIY stores so stupid? And also, wouldn’t an enterprising supermarket try to attract customers from another supermarket with lower cleaning product prices?

And why would supermarkets not compete with the DIY stores, if their customers were refusing to buy their cleaning products in favor of the DIY store’s “monopoly” of the liquid glass.

Finally, consumers are going to consume approximately the same amount, in the aggregate. Why would supermarkets care if you spend your hard earned cash on cleaning products, or on liquid glass? All they care about is making sure they have what the consumer wants, at prices that attract the most consumers.

It appears that Lin doesn’t believe in free markets, nor does she understand the concept of voluntary free exchange.

“We got great weather, wonderful bbq, and cold beer…”

Texas Governor Rick Perry on Instavision – 14:03 in.

Watch the whole thing. If Texas were ever able to secede, I would move back and watch the crash from there. Who knows, maybe the states like Texas could pressure the Feds into giving up their power…

Iceberg Dead Ahead

I’ve had this “knowledge” for a long time that the USA was headed for a financial disaster. Nothing in the immediate future, but someday far from now, all of the Ponzi schemes that the Federal government keeps pumping out are going to kill our economy. Most of this knowledge comes from my father’s belief in fundamentals as they relate to macro economics, and his talent for not letting a good opportunity to point these fundamentals out to me go by. Eventually, even a thick skull like mine will absorb the teachings from that kind of barrage.

Anyway, this knowledge consists of a few things that are coming to a head in the near future:

- Baby Boomers Retiring. The Mother-of-all-Ponzi-Schemes, or so-called Social Security, will soon be paying out more than it collects when more and more baby-boomers retire.

- Medicare / Medicaid. An aging population combined with rising medical expenses!

- Healthcare Costs Escalating. Has your insurance ever gone down, or your coverage ever gone up, or has the complexity ever been reduced? Mine neither.

- Deficit Spending by the Federal Government. Despite what seems to be common knowledge that we had a surplus in the late 90’s, spending by the federal government has never in my lifetime been below tax receipts (see Bureau of the Public Debt, US Treasury)

- Federal Debt Financed with Short Term Loans. Short term borrowing is a recipe for disaster – unless you are repaying short term. But we aren’t repaying (see #4). If interest rates go up to even modest amounts, we will be adding another $ trillion to the annual deficit.

- Consumption Economy. I’ve heard about the trade deficit my whole life. Can an economy sustain several decades of high and increasing trade deficits?

- Ever Increasing Regulatory Environment. Our elected officials seem to think there is no cost to Sarbanes-Oxley or OSHA or The Patriot Act. Or a bazillion other regulatory burdens.

- Taxes. Never. Go. Away. I remember when I was a kid, the sales tax was less than 5% in the part of Texas where I grew up. It’s over 8% now in AZ, PLUS as income tax! My property taxes increase every year, even when my house is worth 40-50% less. And my Truck Registration was over $750 the year I bought it (‘06).

I had this knowledge well before the events of last summer. I wasn’t that concerned because I felt like it was too far away to get too worked up over – after all, we’ve been hearing about this sky-is-falling stuff since Perot in 1992. But sooner or later, these looming disasters are going to kick us on the crotch.

Full Steam Ahead…

If McCain had won the election, I’d still feel like we’re headed for the iceberg. I’m sure he would have tried to slow the ship. I’m sure he would have introduced various reform packages that each would have been steps in the right directions, but could he have stopped the inevitable? Could he have reformed Social Security, Medicare & Medicaid, balanced the budget, absorbed the gigantic cost of raising interest rates in order to refinance a $9 trillion debt with long term loans? Could he have turned the momentum of spiraling healthcare costs, and converted our economy into a production economy with a trade surplus?

I don’t think would have been able to come close. McCain was somewhat fiscally conservative, but he had a weird idea of free markets. He had his name of a lot of non libertarian bills (McCain-Feingold, Lieberman-McCain, etc.), so it’s questionable as to how hard he would push for reform.

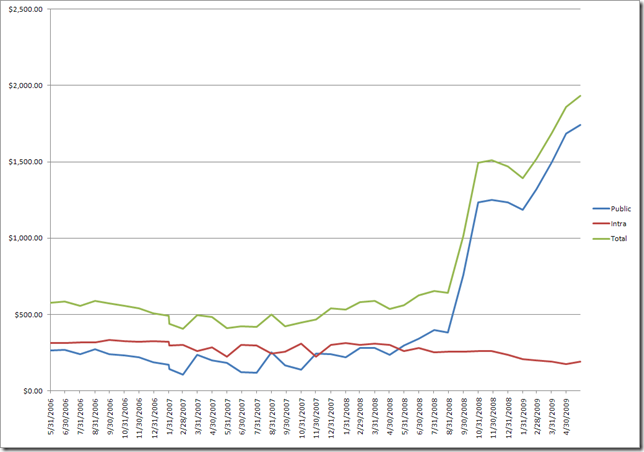

But McCain didn’t win – Obama did, as he’s fond of reminding us. And far from slowing the ship, Obama is shoveling the coal faster than anyone ever has ever dreamt possible. Hank Paulson and Ben Bernanke started this mess under Bush, but Obama has taken the wheel and kept his foot on the gas. Take the following graph of Annual Debt Increase updated monthly (in $billions):

This just addresses the debt issue, but we all know that Obama has grand plans for increasing our Medicare / Medicaid coverage, and is an advocate of Federal Regulation. He has taken over most of our nations banks, and two our of three of our domestic automakers.

And today, the Democratic controlled House passed a bill to force US companies, and therefore US consumers, to pay additional taxes for CO2 emissions

Ship of Fools

It seems like every single decision this government makes is the EXACT wrong decision – especially when it comes to economic decisions.

So if we are going to hit the iceberg anyway, I say “Full Steam Ahead!!” Let’s sink this ship while we still remember free markets, and when the decisions made are so dramatically obvious to everyone.

Maybe if we crash soon, our public might have the will to enact real constitutional protection that really limits what damage our government can do.

In the coming months, I am going to make an effort to point out some of these foolish decisions, but with a positive outlook! The faster and harder we crash, the faster we can get back to being freedom loving Americans!