“We got great weather, wonderful bbq, and cold beer…”

Texas Governor Rick Perry on Instavision – 14:03 in.

Watch the whole thing. If Texas were ever able to secede, I would move back and watch the crash from there. Who knows, maybe the states like Texas could pressure the Feds into giving up their power…

Iceberg Dead Ahead

I’ve had this “knowledge” for a long time that the USA was headed for a financial disaster. Nothing in the immediate future, but someday far from now, all of the Ponzi schemes that the Federal government keeps pumping out are going to kill our economy. Most of this knowledge comes from my father’s belief in fundamentals as they relate to macro economics, and his talent for not letting a good opportunity to point these fundamentals out to me go by. Eventually, even a thick skull like mine will absorb the teachings from that kind of barrage.

Anyway, this knowledge consists of a few things that are coming to a head in the near future:

- Baby Boomers Retiring. The Mother-of-all-Ponzi-Schemes, or so-called Social Security, will soon be paying out more than it collects when more and more baby-boomers retire.

- Medicare / Medicaid. An aging population combined with rising medical expenses!

- Healthcare Costs Escalating. Has your insurance ever gone down, or your coverage ever gone up, or has the complexity ever been reduced? Mine neither.

- Deficit Spending by the Federal Government. Despite what seems to be common knowledge that we had a surplus in the late 90’s, spending by the federal government has never in my lifetime been below tax receipts (see Bureau of the Public Debt, US Treasury)

- Federal Debt Financed with Short Term Loans. Short term borrowing is a recipe for disaster – unless you are repaying short term. But we aren’t repaying (see #4). If interest rates go up to even modest amounts, we will be adding another $ trillion to the annual deficit.

- Consumption Economy. I’ve heard about the trade deficit my whole life. Can an economy sustain several decades of high and increasing trade deficits?

- Ever Increasing Regulatory Environment. Our elected officials seem to think there is no cost to Sarbanes-Oxley or OSHA or The Patriot Act. Or a bazillion other regulatory burdens.

- Taxes. Never. Go. Away. I remember when I was a kid, the sales tax was less than 5% in the part of Texas where I grew up. It’s over 8% now in AZ, PLUS as income tax! My property taxes increase every year, even when my house is worth 40-50% less. And my Truck Registration was over $750 the year I bought it (‘06).

I had this knowledge well before the events of last summer. I wasn’t that concerned because I felt like it was too far away to get too worked up over – after all, we’ve been hearing about this sky-is-falling stuff since Perot in 1992. But sooner or later, these looming disasters are going to kick us on the crotch.

Full Steam Ahead…

If McCain had won the election, I’d still feel like we’re headed for the iceberg. I’m sure he would have tried to slow the ship. I’m sure he would have introduced various reform packages that each would have been steps in the right directions, but could he have stopped the inevitable? Could he have reformed Social Security, Medicare & Medicaid, balanced the budget, absorbed the gigantic cost of raising interest rates in order to refinance a $9 trillion debt with long term loans? Could he have turned the momentum of spiraling healthcare costs, and converted our economy into a production economy with a trade surplus?

I don’t think would have been able to come close. McCain was somewhat fiscally conservative, but he had a weird idea of free markets. He had his name of a lot of non libertarian bills (McCain-Feingold, Lieberman-McCain, etc.), so it’s questionable as to how hard he would push for reform.

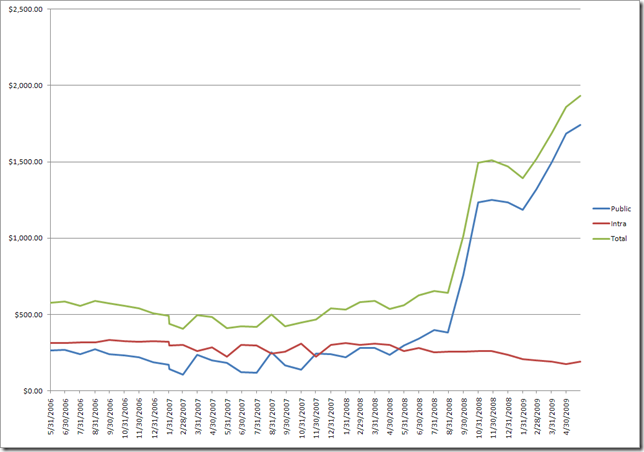

But McCain didn’t win – Obama did, as he’s fond of reminding us. And far from slowing the ship, Obama is shoveling the coal faster than anyone ever has ever dreamt possible. Hank Paulson and Ben Bernanke started this mess under Bush, but Obama has taken the wheel and kept his foot on the gas. Take the following graph of Annual Debt Increase updated monthly (in $billions):

This just addresses the debt issue, but we all know that Obama has grand plans for increasing our Medicare / Medicaid coverage, and is an advocate of Federal Regulation. He has taken over most of our nations banks, and two our of three of our domestic automakers.

And today, the Democratic controlled House passed a bill to force US companies, and therefore US consumers, to pay additional taxes for CO2 emissions

Ship of Fools

It seems like every single decision this government makes is the EXACT wrong decision – especially when it comes to economic decisions.

So if we are going to hit the iceberg anyway, I say “Full Steam Ahead!!” Let’s sink this ship while we still remember free markets, and when the decisions made are so dramatically obvious to everyone.

Maybe if we crash soon, our public might have the will to enact real constitutional protection that really limits what damage our government can do.

In the coming months, I am going to make an effort to point out some of these foolish decisions, but with a positive outlook! The faster and harder we crash, the faster we can get back to being freedom loving Americans!

If it’s too big to fail…

Glenn Reynolds links to this NYT article asking “If It’s Too Big to Fail, Is It Too Big to Exist?” with his answer “I think so.”

I would follow that question with “Is the US Government too big to fail?” Or, “Is the US Dollar too big to fail?”

What the hell is that?

Here’s the whole page:

UPDATE: It’s Carla Bruni, and Ann Althouse is having a caption contest! Glenn Reynolds is reminded of this photo.

Count me among the 17%

According to Rasmussen Reports:

Twenty-six percent (26%) of American adults believe it was a good idea for the federal government to take ownership of General Motors as the auto giant was on the verge of collapse. Nearly as many--17%--say that Americans should protest the bailout by boycotting GM and refusing to buy its cars. Most Americans are somewhere in between.

I Blame the users

What do you get when you combine a system with a dozen programmers, some of which never heard of data integrity, maintaining a business application based on a database with almost no built in constraints over a period of a couple of decades?

Foreign Flag Count N 876179 NULL 812543 97164 Y 34235 1 2729 N N 1132 N Y 3 Y Y 2 44128 1 305 1 28103 1 Y N 1

Apple Fan Boy

I’ve been called this recently and I would agree. I fell in love with the “it just works” way of Apple. When my wife goes to the mall, I tag along so that I can visit the Apple store. I own a MacBook Pro, and iPhone and and iPod. I also have loads of attachments for the mac; gadgets like the Bose Sound Dock for the iPhone and wireless keyboard and mouse for the laptop. I have tons of software and enjoy working and playing on the mac. I’m messing with xCode and iPhone programming, use parallels to run windows so that I can VPN and RD into work.

I can’t think of anything negative to say about the mac.

My problem… I need to run Visual Studio and Sql Mgmt Studio from anywhere. I picked up a Virtual Machine solution for this but I don’t enjoy it because running OSX and my virtual machines does not give me the performance I desire. I do throttle each but it still does not compare to native speed.

I decided to install the Windows 7 RC1 and boot to it rather than the VM solution. This way I get full dedication of my machines resources to the operating system I choose. It took a little over 30 minutes to do the install, call it 40 if you include the windows and driver updates.

I’m in shock. “It just works”. And it is really really fast. Granted it is bare bones and I am rocking 4gb of ram but this thing cooks. It doesn’t have the bloat of Vista (well it might but they swept it under the rug). It’s snappy, looks great and makes me want to use it. Thank you Microsoft!

Now, for my foot-in-mouth moment: If Microsoft could move Windows 7 to the mobile world and make the Zune HD a little more natural to use like the iPhone, I think they'd really have something they have been missing… A smart phone/pda contender. Let’s be honest, the iPhone, from a human usability perspective, just does it better than any other. They are bound to that silly AT&T contract and Microsoft is not. Ditch the Surface and get this HD phone available from any carrier. Put Win7 on the Zune HD or similar device, nail an app store, destroy Google Android and remind everyone that great software does not have to be open source.

The twitter complaint card

Raise your hand if you like to vent out loud? I sure do and so do millions of twitter users. I've tried to be cautious with what I vent about on twitter because it's public and permanent. You don't want your foul mouth rants following you where ever you go. Sometimes, though, you get frustrated enough that all bets are off and the venting flows freely.

Raise your hand if you like to vent out loud? I sure do and so do millions of twitter users. I've tried to be cautious with what I vent about on twitter because it's public and permanent. You don't want your foul mouth rants following you where ever you go. Sometimes, though, you get frustrated enough that all bets are off and the venting flows freely.

Needless to say, I opened my big mouth on twitter again "Papa Johns has the WORST mobile experience. Mobile should be fast & fluid. No long a$$ registration process. #fail". Unfortunately for me, Papa Johns does not have a dedicated twitza (that's a pizza twitter person) to review negative comments about them.

Rethinking the Global Money Supply

More talk about ditching the US Dollar as the reserve currency in this article. What do you think will happen to the exchange rate of the US Dollar if all those countries who use the US Dollar as a reserve start selling those dollars?

The U.S. response to the Chinese proposal was revealing. Treasury Secretary Timothy Geithner initially described himself as open to exploring the idea; his candor quickly caused the dollar to weaken in value—which it needs to do for the good of the U.S. economy. That weakening, however, led Geithner to reverse himself within minutes by underscoring that the U.S. dollar would remain the world’s reserve currency for the foreseeable future.

Does the US Dollar need to weaken? Higher oil prices, higher food prices, and higher car prices are what we need? Is the problem with General Motors and Chrysler the strong US Dollar? The dollar has been weakening for years. I went to Europe in 2002, and a Euro cost about $0.88 – It cost about $1.60 just prior to the market crash of 2008, where a rush to the perceived safety of the US Dollar caused it to strengthen. That means that a $30,000 Chevrolet Tahoe cost 34,091 euro in 2002, and 18,750 euro in 2008.

It should be the job of the US Government and the Fed to protect the US Dollar – not weaken it. By the way, “overly expansionary monetary policies” is another way of saying “Printing too much money”

The end of the world as we know it

The bad news for me is that i often sound like a crazed lunatic when I start describing my beliefs of the coming economic collapse. The good news is that I’m in good company. When people ask where I'm investing, i tell them that I’m mainly into gold and oil ETF’s, since I want to preserve what little savings I have.

I often get the question “What good is Gold?”, and “It’s just a perceived value.” I am not good at countering that argument, especially since I’ve only been buying it for 6 or 7 months, but I do like to refer to this article by former US Federal Reserve Chairman Alan Greenspan (written in 1966, twenty years before he became fed chairman). The last two paragraphs really hit home with me:

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

The article is titled “Gold and Economic Freedom”, and it goes into great depth of why Gold is real money, and the best form of currency. A Currency that is backed by and redeemable in Gold cannot be inflated. In fact, for most of the history of the United Stated of America, Gold, along with Silver, was the primary asset backing “gold certificates” and other certificates of deposit. Up until 1971, the US Dollar was redeemable for a fixed amount of gold – not to Americans – FDR made that illegal when he cut the value of the US dollar in half in the 1930’s. The first three sentences of the Alan Greenspan quote above bears repeating:

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold.

The US eventually had to drop the Gold standard because they were printing money without actually acquiring the gold to back it up. Foreigners, who could own Gold, were redeeming their US Dollars for the stated exchange rate, causing the real value of the US Dollar to drop. Had the US not made it illegal for it’s own citizens to own Gold, then the US government would never have been able to print money without Gold to back it up.

Gold is real value, paper money is not. If the exchange rate of paper money to Gold goes up (more paper money per ounce of Gold), then it’s obvious that the paper money supply is being inflated. It seems very apparent to me that the real indicator of inflation should always be the the exchange rate of Gold to the US Dollar.

Alan Greenspan says “Deficit spending is simply a scheme for the confiscation of wealth.” Which brings up this chart of the past and projected US Budget Deficit:

And then there’s Gold:

It’s a lot easier sounding like a crazed lunatic when the numbers are on your side. I think I’ll continue to put my savings in Gold.

Confidence in the US Dollar continues to erode

Brazil and China eye plan to axe dollar

In what was interpreted as a sign of Chinese concern about the future of the dollar, the governor of China’s central bank proposed in March that the US dollar be replaced as the world’s de-facto reserve currency.

In an essay posted on the People’s Bank of China’s website, Zhou Xiaochuan, the central bank’s governor, said the goal would be to create a reserve currency ”that is disconnected from individual nations” and modelled on the International Monetary Fund’s special drawing rights, or SDRs.

Hold on to your hats – the US Dollar is dropping like a stone:

The Fed, Inflation, and The Federal Deficit

The past 6 months have been very educational for me from a macro-economic standpoint. I have never been interested in technical economics to the point that i am now, except for some things I naturally understand, like free markets. A Free Market economy is easy to understand to me because it’s my natural reaction to the world of trade. If you’ve ever had a garage sale, or sold something on eBay, you understand it too. It’s simple – you put something up for sale, and if people think your price is reasonable, they will buy it. If not, you have the option of lowering the price.

But when all these bailouts started last September, my Father and brother, who are both professional economists to a degree, started teaching me, as a much more interested student, about the macro economics being massively affected by all of this government intervention. So i started really trying to understand the big picture, and at this point, i think i have a pretty good understanding of it. I can say it seems pretty simple – almost exactly like free markets.

The Fed & Money Supply

Not many people know what “The Fed” is, except that Alan Greenspan used to run it, and now Ben Bernanke runs it. And it’s real important to the economy. And they can lower interest rates.

The Federal Reserve System was originally created, from what I understand, to provide emergency cash to banks when there is a potential bank panic – where too many depositors withdraw their money because of fear that the bank may fold. The purpose seems to have evolved to some kind of political entity that sets the interest rates in order to loosen or tighten the money supply, usually because of the hype surrounding a recession, or inflation fears.

How The Fed affects interest rates

The Credit Crunch, or recent contraction in credit beginning last summer, began mainly because of ridiculously low interest rates for mortgages, usually in the form of ARM’s, to subprime borrowers began to default at high rates. The free market reaction to high default rates is to increase interest rates (who wants to lend at low interest rates when default rates are increasing?) In order to keep interest rates low, The Fed creates MORE money out of thin air, and purchases debt on the open market. This is called Quantitative Easing, and it also increases / inflates the money supply.

The only way to decrease the money supply from quantitative easing is to sell those assets back on the open market for cash (which will increase interest rates), or when those loans are paid by the original borrowers, in the case that they are performing loans. In the case that they aren’t performing loans, who the heck would buy them? If the loans aren’t marketable (i.e. non-performing) then that money is also forever lost to the overall money supply, and the only way to make up for it is for The Fed to raise interest rates.

And if that isn’t enough pressure…

For the first 6 months of this budget year, the US government has already doubled the amount of money it has borrowed all of last year – at the same time our trade deficit has been cut in half. The US government (not to be confused with The Fed) borrows money by holding auctions for Treasury Bills (short term) and Bonds (long term). In March alone they borrowed $192B. Normally in a market where people with money want to loan less of it (exporters to US, banks, etc), and the number of people who want to borrow money is increasing (US Treasury), you would have a price increase – higher interest rates.

The people who normally buy our treasuries (the Chinese, Japanese, Saudis, etc.) all have seen their net exports to the US decrease substantially. At the same time, the US is selling 4x the amount of debt??? There’s only one way this can unfold – more quantitative easing. Ben Bernanke is going to purchase US treasuries in order to keep interest rates down. I’ve heard that the Chinese will continue to buy our debt, but how much can they buy? Are they going to have 1.7 Trillion dollars extra this year, with exports to the US cut in half? Are they going to even have 5 trillion over four years – let alone 5 trillion to lend to us?

Stealing your wealth 101

This is where free markets come in… Our currency is traded on free markets – anyone with a pile of money can trade it for other “stuff” – groceries, gasoline, stocks, treasury bills, wheat futures, Euro’s, Yen, etc. If you sell stuff, you may decide to take US Dollars in trade. If supply is greater than demand, the price goes down, and if demand grows faster than supply, the price goes up.

The same thing goes for currencies – if the supply of the currency is greater than demand, then the exchange rate of that currency goes down. If you increase the supply of a currency by 10% – guess what? It’s value decreases by about 10%. By increasing the supply of US Dollars, The Fed and the US Government are essentially confiscating wealth from anyone holding them.

To Summarize…

- The Fed creates money by loaning money to banks and / or buying assets on the open market, which has the effect of lowering interest rates.

- The Fed decreases the money supply only when loans are repaid to it or when it sells assets it previously purchased, which has the affect of raising interest rates.

- The US Government is borrowing money like there’s no tomorrow, in times when nobody has any to lend.

- Because nobody has any money to lend the US Government, The Fed purchases debt from the US Government with printed money.

- More money causes inflation. Lots more money causes massive inflation.

- Inflation causes interest rates to go up, causing The Fed to create more money to keep them down, causing more inflation, causing The Fed to create more money… you get the picture.

- Holders of US Dollars see their holdings decrease in value, causing them to sell their $, causing the US Dollar to decrease in value even more, causing other holders of US Dollars to sell theirs, causing… you get the picture.

- Finally, with exchange rates for US Dollars at very low rates, the sellers of things we import (remember we import about half of our oil, and most of our consumer goods) will want more US Dollars for them – increasing our prices!

How can you prepare?

If you want to watch something educational, check out this 8 part video. Watch the whole thing to get a good idea of what’s going to happen, keeping in mind that this video was made in November of 2006. This set of videos focus primarily of Peter Schiff’s speech, but the Western Regional Mortgage Bankers Association presented two points of view, the “bull market” view coming from Dr. Barry Asmus. Peter’s predictions are uncanny, and Dr. Asmus’ rebuttal’s are embarrassing in hindsight.

How can one guy get it so right – to the “T”, and the other guy be so wrong? How did Peter know? My guess is that Peter Schiff has known for a long time that bad monetary policy is the root of all evil. It’s like government interference that nobody realized is happening.

If you go to the first question in part 7 of 8, there is a dude who explains to Peter how entrenched into the real estate market he is and then asks if he should slit his wrists… I’ll bet that he now really regrets his skeptical attitude, and wishes he would have believed Peter. If he could go back in time and sell all of his houses in 2006, he probably would. All of Peter’s predictions came true, so who knows – maybe he did slit his wrists.

So if you listen to Peter Schiff now, he would tell you to move your assets out of the US Dollar. Buy gold, silver, foreign stocks, foreign currencies, etc. I would recommend that you buy his book – Crash Proof – also written before the credit crunch – and follow his advice.

My Digital Backup Strategy

I'm an amateur photographer. I've enjoyed taking pictures ever since my grandma gave me a Pentax camera when I was a kid. About two years ago I purchased a Nikon D40 and started using the Flickr photo sharing service so that my wife and I could share our memories with our extended family. Since then I have uploaded over 11,000 high quality images to Flickr.

The whole concept of Flickr was fascinating to me because it's really a dirt cheap high capacity storage solution for media. It's backed by Yahoo! and has been a cinch to work with. I've never worried about the data because they offer paid DVD copies if needed. Also, there are third party solutions that do backups locally.

Recently, something happened that changed my outlook on everything...

I had several hundred photos on a machine that I was selling to a friend. I wanted to move those photos to Flickr but had not gone through and touched them up so I opted to move them to an external hard drive. Everything moved over just fine and I was waiting for a good time to get back into the touch-up editing.

About a month after I sold my old machine I bought a MacBook Pro. The first thing I wanted to test was the TimeMachine backup utility. I already had an external drive and figured I could use it both on the Mac and my wife's PC. Keep in mind that this hard drive contained several hundred photos (and songs) that my wife really wanted. So, with the inexperience of a 5th grader, I slapped the drive on my desk, plugged it into the Mac and was on my way.

I recall a modal dialog that was severed up to me. Something about the drive not formatted for that Mac and that it wanted to reformat it. I heard that it was easy to partition drives on the Mac so that's what I did. Half for the Mac half for the PC. I setup time machine and it worked flawlessly.

Once I had the Mac backed up, I went over to back up the wife's computer and hooked up the hard drive. I decided to check on those files just to make sure they were safe. Nope... Something went horrible wrong. When I formatted the drive, it seems like it formatted the entire drive to be Mac friendly, then partitioned out a windows area. The panic ensued!

I immediately went into damage control mode. How do I recover the files? I search and searched until Google called and asked me to stop hogging their bandwidth. I've tried program after program but I cant get these files back. The strange thing is that the files are there, is some binary crazy encoded format. Each utility can locate the files but they can't read them. I'm screwed!

What I have now is a paper weight. I don't want to use the drive anymore because these precious files are on it. I'm in denial that they are unrecoverable because I haven't taken it to a professional yet for an opinion.

The good news from this experience is that I've become much more data conscious. I've got the mac doing monthly/weekly/daily/hourly backups. My wife's computer is SOL for now. I tried to use Windows Live Sky Drive to copy the files that are important to her to a safe place; what a joke that was. I'm using mozy for now but I don't care too much for it.

The solution...

I just purchased an HP EX487 MediaSmart Home Server. It's a 1.5 TB backup solution for the house. It also centralizes all types of media content that can be shared from anywhere with an internet connection. I really like the iTunes centralization so that my wife and I can hook up our ipods to one library. It also offers integration with Flickr for my photos. I fully intend to load my pics on the mac, edit until my hearts content, move the data to the server and have it automatically load my pictures on flickr.

So, in addition to a backup solution for both my mac and pc's, I now have a file sharing server which means I can load all my HD video (got like 100 GB on my mac right now), audio files and other crap onto this server and keep it off of my machines. You can call Flickr my redundant backup solution for photos. I don't like clutter and I hate slowness and I hope to really clean things up. With my new 20 MPS internet connection I suspect that the backups and file sharing will be very fluid. Did I mention this thing has dual 750 GB 7200 RPM drives?

I also have a separate 1 TB drive that I will use to backup the server. I'm currently investigating online storage that is cheap and integrates seamlessly with the home server so that I'm completely covered for any disasters at the house.

I think I've said too much already. I suspect I'm going to be backing up the in-laws machines now, also my brother, my grandma and aunt. See where this is going? Maybe this was a bad idea.

Warranty void if removed

I’ve had an itch to buy a desktop system for a while, and I've been debating everything from a Mac Pro Quad Core to a home built system. All the new stuff seemed so frickin expensive, and I didn’t have any more programming I could pimp out to my wife, so I was reluctant to try to sneak a $3000 charge by her… Then I remembered a site from which I’ve bought at least three other computers: Dell Financial Services Direct Sales. I found a 3.2 GHz Intel Dual Core Xeon 5000 with no OS for only $490. It only had 2gb of ram, but I knew I could get more, and I didn’t need an OS, since I was going to experiment with Ubuntu on it. So I whip out the ol’ MasterCard and order it.

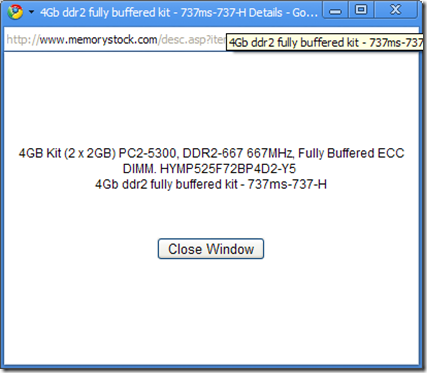

Enter MemoryStock.com

In the meantime while the MasterCard was still warmed up, I went memory shopping and found the memory i needed at MemoryStock.com. I verified the memory configuration with Dell and a couple of competing sites and placed an order. Confirmation emails quickly followed with confidence building shipping notices and tracking numbers. I’m thinking these guys are obviously well versed in the field of online customer service!

A couple of days later the 4gb of memory arrives, two days ahead of the computer. Of course, I rip open the fedex package and take a look at the merchandise. I know what to look for, since the day before I rummaged through the ram graveyard at my company to see if there was any “obsolete” memory I could use. See if you can spot the signs of a rip-off in the pic:

That’s right – there’s a sticker over the memory model / speed sticker that says “Warranty void if removed”. This is clearly a sticker with the sole purpose of hiding the model of the memory. It would have been a bit less conspicuous if the giant word “MemoryStock” identifying the seller hadn’t been there – at least I might have suspected that it came from the manufacturer that way - for a couple of minutes. The sticker covers nothing else – it is obvious that there could be no other purpose for it.

Something tells me that this is not the PC2-5300 DDR2 667 ecc Fully Buffered memory that i ordered (something beside my x-ray vision).

The next day I initiate one of those online customer support chat sessions with them:

Johnson> Hi, thanks for contacting MemoryStock - How may I assist you today? *** If this conversation ends abruptly (or) if you no longer receive messages from us, please feel free to initiate another chat interaction. You may also send a email to info@memorystock.com and our support team will respond to your queries. ***

Johnson> How may I assist you today?

Crash> i ordered memory from you guys, but ther is a BIG sticker over the model #

Crash> warranty void if removed

Johnson> yea

Crash> why?

Johnson> warranty sticker

Johnson> we offer lifetime warrenty

Crash> i'm shipping it back if i cannot see the model

Crash> and i will call my CC company to charge it back 100%

Johnson> can you please call to our Rma dpt 209-475-0152 exnt#102

Johnson> call after 10.30am CA time

Crash> will do

Johnson> they will assit you for this matter

Johnson> Thank you for using Memorystock Live Chat Support. It is our great pleasure to serve you. If you need any other memory help or information please do not hesitate to contact us. You may also email us atinfo@memorystock.com.

I call this number at the agreed upon time and left a similar message with instructions to call me back by end-of-business that day. Later that day I called again and left the same message. No call.

Worried that I might be mistaken, I check the order confirmation email. I didn’t check it when it arrived, but when I reread it, the memory model number was not there:

737ms-737-H - Precision Workstation 490 4Gb ddr2 fully buffered kit

so i go back to their website and trace my steps. 1st the memory options for the Dell WS490:

Memory Size Chip Description Part Number Price OEM Part# 2GB ECC Kit 1024MB-533MHz DDR2-533 PC2-4200, 240p FBDIMM, ECC, Fully Buffered, 1.8v

688ms-688 $59.95 In Stock 4GB ECC Kit 2048MB-533MHz DDR2-533 PC2-4200, 240p FBDIMM, ECC, Fully Buffered, 1.8v

689ms-689 $99.95 In Stock 8GB ECC Kit 8GB Kit 533MHz DDR2-533 PC2-4200, 240p FBDIMM, ECC, Fully Buffered, 1.8v

786ms-786 < $264.95 In Stock 1GB ECC Kit 1GB kit -667MHz DDR2-667 PC2-5300, 240p FBDIMM, ECC, Fully Buffered, 1.8v

735ms-735 $29.95 In Stock 2GB ECC Kit 2GB Kit 667MHz DDR2-667 PC2-5300, 240p FBDIMM, ECC, Fully Buffered, 1.8v

736ms-736 $79.95 In Stock 4GB ECC Kit 4GB Kit 667MHz DDR2-667 PC2-5300, 240p FBDIMM, ECC, Fully Buffered, 1.8v

737ms-737 $149.95 In Stock 8GB ECC Kit 8GB Kit 667MHz DDR2-667 PC2-5300, 240p FBDIMM, ECC, Fully Buffered, 1.8v

791ms-791 $279.95 In Stock

I ordered the 737ms-737 option – clearly labeled as DDR2-667 PC2-5300, so i clicked on that option again:

House-Brand

4GB PC2 5300 DDR2 667 FULLY Buffered 4 GB Dimm Kit Precision Workstation 490 Memory RAM, Memorystock Part No: 737ms-737 Description : 4GB Kit of(2pcs x 2GB ) PC2-5300, DDR2-667 667 MHz, Fully Buffered ECC DIMM.. Compatible memory for Precision Workstation 490

We carry many major manfacturers compatible memory upgrades for the selected model

Please choose and order your desired brand memory:

Brand Sale Price Qty $149.95 Check quantity discount Hynix $164.95 Check quantity discount

Again, the DDR2-667 PC2 5300 is confirmed. Not wanting the house brand, I chose the Hynix option, where I see:

Your Shopping Cart

ITEMS:1

Items

Qty.

Price Each

Total Price

Remove Item

Precision Workstation 490 4Gb ddr2 fully buffered kit - 737ms-737-H Details

$164.95

$329.90

The Details link displays the model number again:

As you can see, the part number in the email sent to me matches the memory model i wanted. So why would the sticker be there? Why would they be so quick to point me to the RMA department when all I asked for was to verify the model number?

They must be a rip-off organization…

We need better software

As I continue my quest to become a GTD master, I'm starting to realize that computers and software can sometimes cause bottlenecks and may even be getting in the way of you getting things done.

For example, let's say I'm writing code in Visual Studio. I need to store some data so I open up SQL. My app is web based so I open a browser. I am concerned about browser compatibility so I open other browsers. I find an issue that requires research so I open Stack Overflow. I learn something important so I open Evernote to store it. I realize that I need to fix several things so I create a project in remember the milk; then Crash hollers at me "dude, read that email I just sent you".

Each time I leave an app to open another app the context is lost. If I were to go to lunch and come back to this mess of open applications, I really don't know why remember the milk is open and what that has to do with the line of code Visual Studio focused on. It's take time to read the content of both and rebuild the context in my brain again.

This seems inefficient. I want to keep a so called story of what I'm working on. I want to know that the line of code I'm on directly relates to the RTM task I just created, and not because I named the RTM task something obvious.

Make sense?

** Update **

This software partially fits the concept I'm describing. If I could take this concept and make a fluid tie directly into the applications I use daily, it would be perfect. I'd have a single piece of software that satisfied my daily needs for contextual workflow.

I don’t need no stinking QA!

Have you ever intentionally skipped sending a change to QA because you were confidant there were no issues with your %code?

I think we are all guilty of doing this from time-to-time. Have you ever been burned by this decision? Are you held to a level of responsibility so high, that if a bug were introduced by your hand and it was discovered that you bypassed QA on purpose, your job would be at risk?

I bring this up because something was brought to my attention today that left my jaw on the floor after hearing it. While I realize I’m not perfect, I take great pride in the fact that I don’t write buggy code. I think this pride is something all programmers should strive for. Apparently, not everyone shares this opinion with me.

Here is the story as told to me…

A senior programmer made a change to a mission critical piece of our application and was lobbying for bypassing QA because the change “works”. QA was persistent in wanting to understand exactly what changed because they knew something this critical MUST be tested. The programmer went so far as to give QA a demo from a development machine and said “see, it works”. QA responded with a series of questions until the programmer said “I only changed this one area of code to make this work”. QA persisted with questions and tried to throw curve balls at the programmer in an effort to get the programmer to discuss more details of the programming change. Finally, the programmers manager came buy and joined the conversation. This manager understands the importance of QA and began the discovery process.

This went on for several minutes until it was finally discovered that the programmer did not make one change to an area of code. The programmer modified 15 mission critical programs. I repeat, the programmer modified 15 mission critical programs.

It was then suggested that not only should QA be testing the programmers change, but they should also be testing all aspects of the application that relied on the 15 programs that were changed. The programmer said “Oh, yeah, I guess so”.

Have you ever made a change to 15 programs and felt comfortable with no testing? How about if they were mission critical and crucial to both your clients revenue stream and yours? Would you still be able to sleep at night knowing that you didn’t test?

By they way, this programmer is more senior than I am. Well, on paper anyway, not in practice.

Sending an email without ever opening a mail client or browser

Something strange is happening to me. I seem to be using my mouse less and trying very hard never to take my hands off the keyboard. I know many older and more experienced computer users that are like this; they are old an crotchety. Am I becoming one of them?

Why am I so fascinated with the fact that I can do nearly everything on my computer without ever touching the mouse? In Visual Studio, I build, get latest, checkout, etc all with keystrokes. In outlook, I send email, reply to email, scan email and never take my hands away from the keyboard.

When I got my Mac Book Pro, I noticed they keyboard is much better than anything I've ever had in the past. I feel like I type faster now, but that still doesn't explain why I'm obsessing about not using my mouse. In fact, I went and bought the "Mighty Mouse" because I'm a mouse guy. I come from the drag-and-drop programming era. Things are changing... Maybe it is because I have more responsibilities at work and an urgency to be more efficient? Maybe it's because I'm a father of two and seem to have less and less keyboard time. Maybe it's because I implemented the GTD system in my life and this is just a natural progression of a person who is efficient.

Here is where this all started:

I was introduced to a mac application called Quick Silver. "It's the holy grail of application launchers", so I was told. I didn't really know what an app launcher was before this. I simply pinned the apps I needed in the start menu and they were always a click away.

The app launcher is mega smart. It has some indexing gigatron that knows exactly what I'm looking for with just one or two key strokes. What does this mean for me? Well, lets say that I want to open Tweet Deck. I typically grab the mouse, click the start button, and go down the menu to about the 3rd positions and click. With Quick Silver, I hit control > space > t and BAM! I'm in. It's way more efficient because I've slapped those keys in about the same time it would take me just to move my hand over to my mouse.

This equates to more efficiencies in my day to day work which means better faster programming, faster responsiveness to things like emails and issues, happier clients and customers and hopefully a happy boss + a happier salary.

So, here is where this comes in really handy. As I've written before, I'm trying to become a GTD master. I have an obsession with it and I'm good at it. I use RTM and Evernote exclusively now and I've found that using a app launcher allows me to quickly get through my GTD process without leaving the keyboard. I have Evernote and RTM as contacts so quickly sending myself an email, which is converted into a task or a note, depending on the system I target, is a sinch with this app launcher.

A real life example using Quick Silver:

I want to send an email to my Flickr blog. I simply type ctrl > space bar > this is a test > E > F > Return and it fires off an email without ever opening the mail client, or without me ever having to open the web browser. Think about it... How long does it take you to type "ctrl(1) space(2) this is a test(3) e(4) f(5) enter(6)"? So five key strokes, plus the subject of your email, is all it takes! "Hello", is five key strokes. "Phone" is five key strokes. See what I mean? This is amazing. Think about the time that it takes just to open outlook and wait for it to load before I can even compose a new email, which also takes time for the word composer to load. I could probably send 20 emails out within that time.

Windows users, you are not alone. They have a program called Launchy that I'm using on the work pc. This is just like Quick Silver and has a nice scripting engine. To send emails using Launchy, I found a little VB script that composes an email and sends it using my gmail smtp account.

I hope you try this out and become an app launcher ninja like me!

Why is an intuitive UI important?

I recently used American Express Travel to book a vacation for my wife and I. We are celebrating her 30th birthday. I have a ton of points so I wanted to book an awards travel. Seems simple enough. I've used points before to rent a car; I recall a slight hassle back then, but hey, I wanted to use my points.

So, here is the issue. We live in a world of simplicity. Everywhere you look, interfaces get easier and easier to use. Online banking, dinner reservations, email, its all super easy because that is what users have demanded. When I run across poorly designed web pages at work, I make it a point to fix it; time permitting. If it sucks bad enough, it will get fixed sooner rather than later. If it just plain doesn't work at all you can bet that Crash will be asking WTF?

American Express is a reputable company with a lot of resources. I recently worked with their international team on a credit card interface and it went very smooth. Needless to say I was shocked to find that they had such a poor interface for booking rewards travel. I assumed the site would be perfect because of their name; that was a poor assumption.

I'll try to explain the experience:

Here is the Membership rewards area where I'm applying 19k points to my hotel reservation. As soon as you click the "Redeem the full balance" radio button, the "Amount credited to your Card" is updated on the right and is highlighted in yellow. Seems simple right? I'll get back to this one in a minute.

Section #3 is where it asks you to select a method of payment. I was using my points, but wanted to pay with a Visa. So, I selected Visa, plugged in my data and moved on. Everything seemed normal, no surprises.

Once I processed the reservation request, an error occurred. The error stated that I did not provide the Card Identification Number for my Amex. I was not paying with my Amex, why do they need it? Also, I noticed that the "Use Another Card" option was gone. Had I been doing this in Firefox I would have used firebug to see exactly what was going on. The last annoyance was that the data I mentioned earlier with the "Amount credited to your Card" was wrong. It no longer reflected the credit I was getting by using my points, yet the radio button was selected.

This smells like poor state management. Why have the values not persisted through this round trip?

My wife was wanting me off the computer, both babies were crying and I was in a hurry so, like user that was just introduced to the Internet, I clicked proceed with the reservation. Can you guess what happened? They charged my Amex, not my VISA. WTF? I'm pissed that this happened. Not because it absolutely had to be the Visa, but because I wanted it to be the Visa and I didn't get what I wanted even though I was very deliberate with my intentions.

I posted about this on Twitter and shortly after I received a customer satisfaction survey. I'm not sure that was related but I was glad to give them some feedback.

Using a Blog to Publish… Everything!

Last week we finished up with our second sprint – Wednesday was the last day and Friday was Demo Day. One of the new features added during the sprint, as Meat mentioned, was the integration of a Blog into our primary application. It’s not a real blog in the way that most people think of a blog – random thoughts, opinions, and politics, but rather a series of documents describing specific features and modifications to the application itself.

Background

A couple of years ago, I pimped out some programming to my wife for a new set of golf clubs. She helps run a dog rescue, and their old website sucked – it was traditional html in the format of something you would see back in the mid 90’s. They we constantly rescuing dogs and looking for adoption candidates, and needed a better way to help people understand what the status of the dogs that were going through the rescue process. I delivered a website that helped with the dogs part of it, but she was constantly asking me to update the front page.

Back to the Sprint…

In the previous sprint, one of our business analysts was tasked with delivering .pdf documents for some of our more popular reports describing each report in some detail. We were planning on showing the document in some kind of iframe when a user clicked on the report description page. In reviewing his work, i realized that we could use this kind of documentation all over our application, but I wasn’t too crazy about .pdf documents being the method of delivery. So I brainstormed with Meat and a couple of other lead developers and decided to blog our documentation.

Meat wrote the Atom Interface classes and made it easy for us to drop them onto any page, and I worked on selling the concept to the rest of the Senior Management team.

Whatever you do, don’t mention “Blog”

In a “Roadmap” meeting after our second sprint was well underway, a couple of VP’s were concerned about the amount of “stuff” coming out, and how to get the clients and support staff up to speed on new features. I mentioned the blog concept – how I thought it would be a good way to get the word out on new features – and yikes – it was met with a lot of skepticism. I think it would have been an easier sell if I hadn’t used the word “Blog”. I should have called it “A Collaborative Interactive Article Authoring and Publishing Tool”.

I never really sold the concept to them, but they reluctantly agreed to wait until the demo before passing judgment. I did get them to consider having the support managers actually participate in the sprint, and author some of the blog content, but I haven’t heard back as to whether or not they will. It was exciting to me because up until that point I hadn’t considered anyone besides the software development and QA teams would actually author any “articles”. Now, the more I think about it, the blog is a PERFECT tool for this – and I want as many authors as are willing to post.

Context Sensitive Blog

Demo Day

In order to help drive the concept of the blog, and to help sell the idea that we should have many authors, we asked all of the team members to write one article each on a new feature they were adding during the sprint. So Friday, we rolled out the concept of the blog, along with all of the team’s content, and the feedback was emphatically positive. Several of the chickens expressed interest in writing content, and others called it the most exciting feature they’ve seen in years.

I don’t think I’ll have any trouble selling the concept now…